What is a Self Invoice?

A self-invoicing arrangement affords vendors the reliability of having the payment sent by the customer and relieves vendors of the time involved in preparing an invoice. Your credit applications will be processed faster, and expense payments can be made more quickly with self-invoicing.

Self-invoice payments are quicker than debit payments as they do not go through the same verification process. The data required for self-billing is much simpler and should be provided by the customer instead of the supplier. Self-billing invoices can only be raised on credit terms with GST registered businesses. To do this, one party in the business relationship must be GST registered and will act as the VAT invoice issuer, while the other party acts as a private individual who pays on its own behalf.

We’re so used to waiting for an invoice that we don’t often think about what the process is. The traditional process involves having a customer sign and receive an invoice before work can commence and reconciling this with timesheets at a later date before payment is due. This results in a lot of busy work and potential errors, as there are multiple points during the project where unproductive steps occur.

The use of the self-invoice method has several advantages. The customer no longer needs to wait for an invoice from the supplier and reconcile it with the timesheet to make payments. With this method, the supplier’s work is also more accessible because they can directly approve the timesheet after delivering services without having to prepare an invoice first.

It is a fact that when a customer receives an invoice, they immediately register it in their memory as a debt to be paid. Therefore, the financial side of the relationship between the customer and the supplier can be considered “finished” because it is no longer necessary to think about it or follow up on it.

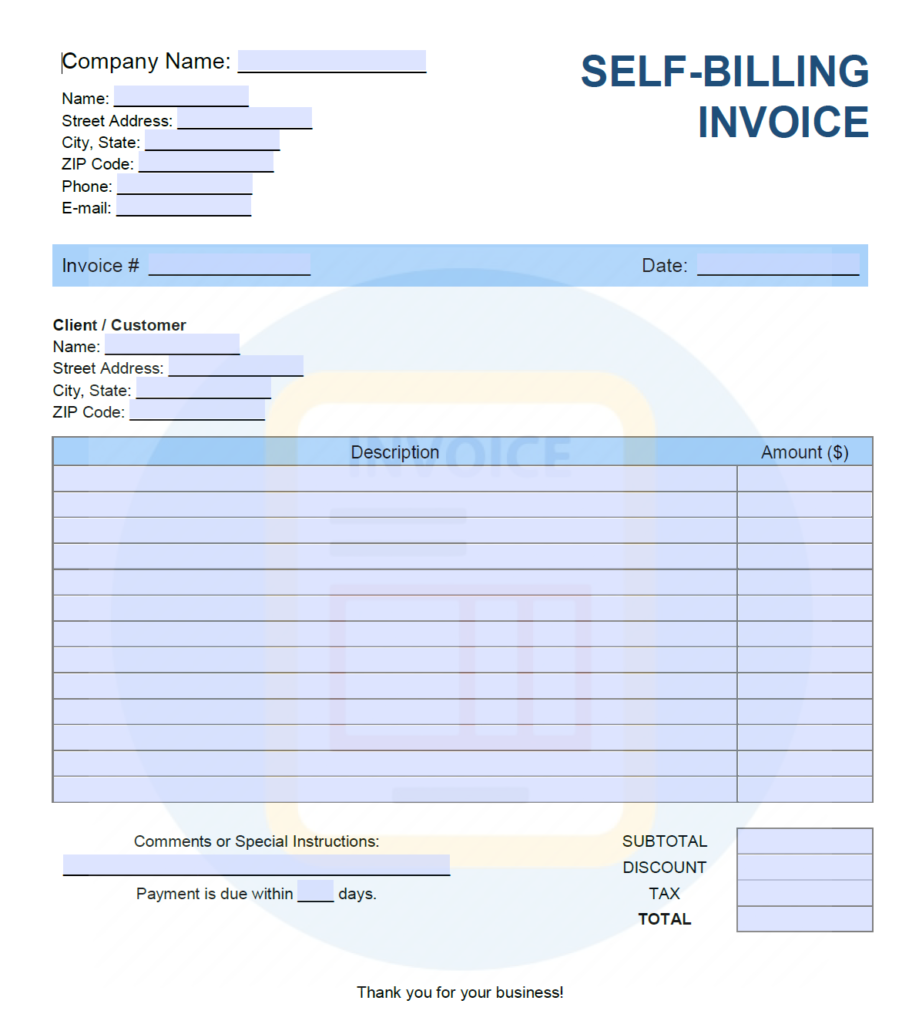

Self Invoice explained format:

What information should you fill in when creating a Self invoice?

1) Name of the company and information on the services and goods provided

2)The unique 16 digits alphanumeric serial number that is relevant to the financial year in the context

3) The date on which the self invoice is being issued

4)Name of the recipient, their address, and their GSTIN number

5)Description of the services rendered for which the reverse charge is already paid for

6)The amount of money that is to be processed to the supplier as payment

7) Percentage and amount of tax charged under CGST, SGST, IGST, and cess

8)The address of the place where the goods/services are supplied from, their state, interstate codes, if any, and area codes if applicable

9)Digital or physical signature of the supplier or any person who has the authority to represent the supplier legally (somebody the supplier has employed to oversee such activities)

Invoicing under RCM for record-keeping

For perfect record-keeping of self invoices generated by you, you are required to produce certain documents mentioned below.

1) Photocopies of all the self invoices you or your organisation has made with the supplier (s) till date.

2)The name, number, address, and GSTIN of all the suppliers who had agreed to get into the self invoice system with you.

If you decide to outsource the process of self-invoicing to a third party, you are still liable for maintaining the records. If the compulsory records are not kept, the invoices issued will not satisfy VAT invoices’ requirements; therefore, you cannot claim any input VAT back. Do not forget that if HMRC needs them, you will need to provide them with your agreement and invoices.

Advantages of self invoicing under GST

It’s a time saver. As you know, the process of producing your own invoices can take considerable time and investment. As self-bill invoices are generated from approved timesheets, you’re saving time and getting all of the protection you need, as they will have accurate rates, dates, and days worked, in addition to all the legally required information on each invoice.

You can be invoiced electronically anytime. Through self-service, you are able to generate your own timesheets and invoices directly from the system – provided you have your unique set of permissions set up correctly. MyBillBook’s flexible self-service options allow you to choose when, how often and where you are going to invoice from.

Conclusion

The Goods and Services Tax (GST), the most significant tax reform by the BJP government, was proposed in 1999. Following years of design and implementation were rolled out on July 1, 2017. The new tax regime has been in practice for almost a decade now. However, the ongoing COVID-19 economic crisis has stirred confusion among taxpayers. GST rules have seen many changes suddenly due to concerns from the Ministry of Finance and the Central Board of Indirect Taxes and Customs (CBIC).

While the GST tax regime is still in its transition phase, many small and medium-sized enterprises struggle to understand the basic structure and functioning of the system as it stands. This article aims to provide a brief insight into some of the current GST rules that will help businesses reap the benefits of this comprehensive taxation model.

Our all-in-one custom solution is mainly crafted to enable small and medium-sized businesses to focus on their core solutions. At the same time, our service suite seamlessly takes care of the financial side of things.

Get in touch with our experts today to get a free consultation on how our solutions can catapult your business into the paradigm it aims to achieve.