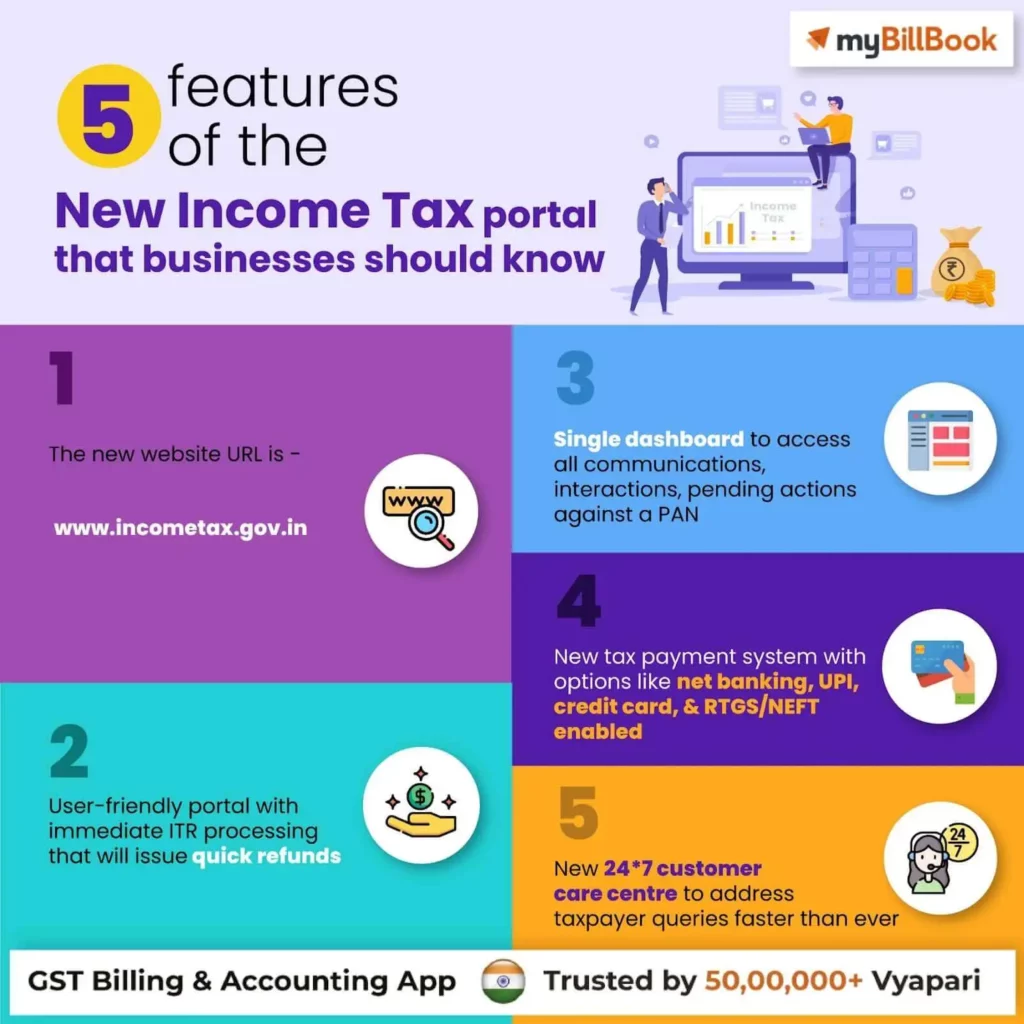

The income tax department has launched the new income tax portal on 7th June 2021. The e-filing portal 2.0 is set to smoothen the e-filing services for the taxpayers of the country. The department sent this message to the taxpayers on the release date – “Dear taxpayer, The Income Tax Department is happy to inform you of the launch of its new e-filing portal www.incometax.gov.in on 7th June 2021.” Read this article to know 5 important features of the new income tax portal.

- New website URL – The website URL has been changed from www.incometaxindiaefiling.gov.in to www.incometaxgov.in. The taxpayers can access the new portal using their previous password & log id as their PAN.

- More user-friendly portal: The new income tax portal will be easier to use than the current one. The portal will be integrated with instant ITR processing, resulting in faster refunds for taxpayers. Currently, IT refunds take around 30-45 days from the date of filing ITR. However, the new portal is expected to reduce taxpayers’ refund wait times. Furthermore, taxpayers will be able to file their income tax returns for free (online/offline) using ITR preparation utilities. Taxpayers with no prior tax experience will be able to file ITRs on the new income tax portal without difficulty.

- Single dashboard for all interactions: The new IT portal will show all interactions, uploads, and pending actions against a PAN on a single dashboard.

- Multiple options for on-portal tax payments: New tax payment alternatives, such as online banking, UPI, credit card, and RTGS/NEFT, would be available through the new ITR filing platform. Taxpayers will be able to pay their taxes using these payment methods from any bank account. The department aims to simplify the current payment system & encourage digitisation.

- 24*7 support for taxpayer queries: The Income Tax Department will open a new customer service centre that will respond to taxpayer questions more quickly than ever before. The 24-hour support team will assist taxpayers with immediate answers using FAQs, tutorials, videos, and a chatbot/live agent.

Vat Value Added Tax

Section 80TTA Of Income Tax Act

Section 44AD Of Income Tax Act

Section 194A Of Income Tax Act

Income Tax

Corporate Tax

New Income Tax Rules Effective from 1st April 2022

Things Businesses Need to do Before the Financial Year End 2021-22

Last Dates/ Due Dates For GST and Income Tax Returns – March 2022

e-Invoicing Mandatory for Businesses with Turnover Above INR 20 Crore