When it comes to Form 16 and Form 16A, both are important for taxpayers as they have a vital role in regulating the payable tax amounts. Also, they are necessary to file income tax returns as both documents are quite confusing for the taxpayers. Therefore, taxpayers should understand the difference between both forms to ensure a smooth tax filing experience and make the most out of it.

What is Form 16?

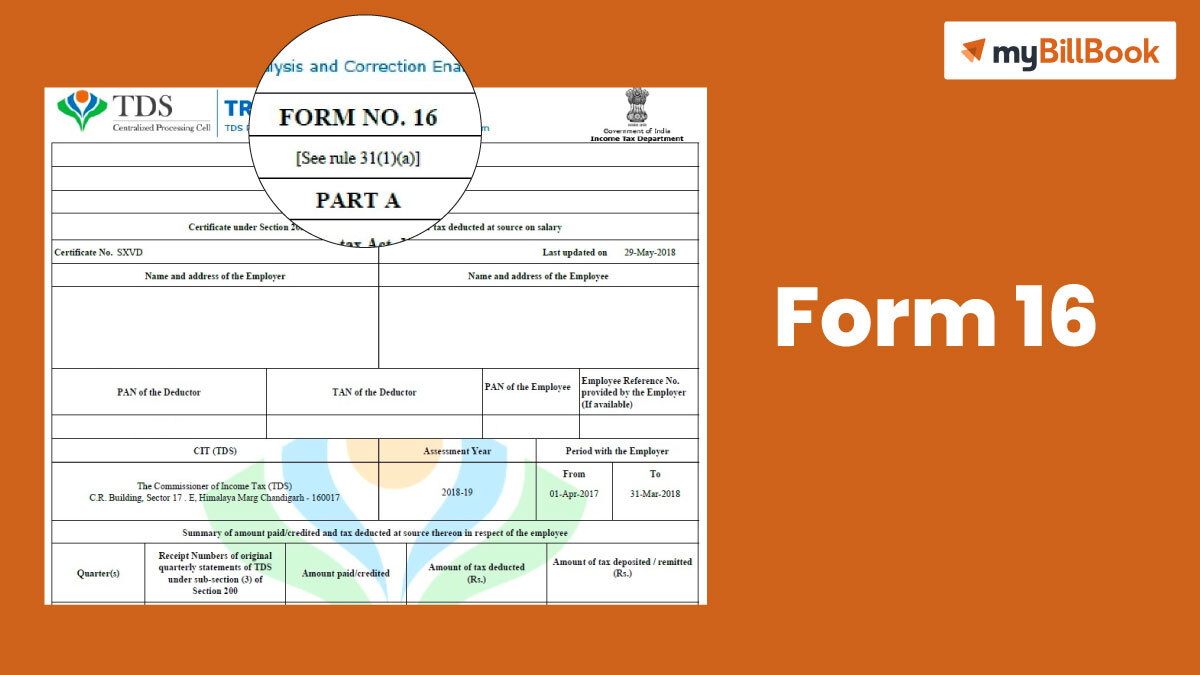

Form 16 is a document where the information about the salary you have earned during the year and the number of TDS deducted has been certified by the employer.

Types of Form 16

There are two kinds of Form 16 other than this which you will get to earn income besides salary. They are as follows:

Form 16A

Form 16 is a TDS document that consists of the TDS deducted on the salary issued by your employee details. On the other hand Form 16A reflects the TDS on incomes that are not the salary received. For example, TDS will be deducted on insurance commission, rent receipts, and interest income earned from Fixed Deposits is obtained in Form 16A. This form discloses the information of the TDS deducted and deposited on the income earned. Moreover, it even includes PAN details, the name and address of deductor/deductee, challan details of TDS deposited, and TAN details of deductor.

Form 16B

TDS deducted in property sales is issued as Form 16B. The amount of TDS deducted on the property bought by the purchaser deposited in the IT department is presented in Form 16B. A deduction of 1% should be done on the property by the buyer and he has to just pay the amount remaining after deduction during the sale of immovable property. He can then submit the TDS later with the Income Tax Department and offer Form 16B to the property seller. This form acts as proof that the deposit of the TDS amount has been made with the Government after the TDS deduction on the property sale.

What is Form 16A and what are its components?

According to Section 203 of the Income Tax Act, 1961, Form 16A is a TDS certificate issued every quarter by employers. As of a note, the payments that are more than Rs. 30000 cannot claim deductions as they are liable for TDS. The certificate provides the correct details of the TDS amount deducted on non-salary income sources such as professional charges, rent, commission, and so on. This form is issued to address that the TDS rate is dependent on the earnings from sources other than salary. When it comes to its components, it comprises details such as:

- The name, PAN, and TAN of the employee

- Bank and TAN details of the employer

- TDS payment number

- Payment details

- Deposited tax amount and date of deposit

These details are also provided in Form 26AS.

What are Form 16B and its components?

Form 16B is a document that consists of data about the tax to be paid or refundable and the calculation of taxable income. In addition, it involves salary and its breakup that has been paid to the employee at the time of fiscal year no matter if it is from one employer or more, and details of any other income provided to an employer by the employee. If we talk about the components of Form 16B, they are as follows:

- Deductions made under the income tax act of chapter 6A.

- Detailed salary details including HRA, deductions claimed like NSC, PPF, Pension, Leave Encashment, Gratuity, LTA, etc.

- Educational tax and surcharge (if any).

One will receive more than one Form 16 if he or she is having more than one job in a year.

How to download Form 16?

Employers only can use the Form 16 download feature. No individual can do this. It is a common misconception that anyone can download Form 16 from the website using the PAN number. But, make a note that only the employers can provide access to or allow Form 16A download to the salaried employees. The employer should issue your Form 16 on deducting TDS from your salary as it is a TDS document that mentions the deposit of TDS amount to the Government. Furthermore, the employer must file Form 16 before the due date of May 31 of every fiscal year.

Difference between Form 16 and Form 16A

Have a look at the table below that shows the difference between Form 16 and Form 16A.

| Form 16 | Form 16A | |

|---|---|---|

| Definition | Form 16 is a document that includes the information of tax amount deducted at source from taxable salary earnings. | Form 16A is a document that involves the details of tax deducted at source from non-salary earnings. |

| Eligibility | It is eligible for salaried persons with regular earnings. | It is eligible for professionals or self-employed persons |

| Issuer | This TDS document is filed or issued by the employer. | This TDS certificate is furnished by banks, financial institutions, and more. |

| Issued against whom | It is furnished or issued against salaried individuals. | It is furnished against non-salaried individuals. |

| Frequency of issuance | It is issued every one year. | It is issued in a quarter part of the year. |

| Applies to | Form 16 applies to interest on securities, dividends, etc. | Form 16A is applied to rent, commission agents, professional charges, and more. |

| Components | PAN details of the employerTAN details of the employerPAN details of employeeTax paidAcknowledgement of paymentEducation cessSurcharges | Bank and TAN details of the employerPAN details of employeeTax paidTDS payment receipt number |

| Law | According to Section 203 of the Income Tax Act, TDS is applicable on chargeable income. | According to Section 203 of the Income Tax Act, TDS is applicable on non-salary income. |

| Relationship with Form 26AS | Includes only the TDS details of Form 16. | Involves all details contained in Form 16A. |

| Verification | Verification through the online portal is possible. | Verification through the online portal is possible. |

With the help of this table, you will know the actual difference between both the forms and how they both are very crucial for taxpayers. These forms are beneficial for the verification of important income details along with the TDS amount deducted as well as the right TDS rate.

FAQs related to Form 16 and Form 16A

1. When Form 16 is furnished?

Form 16 is issued every year, for one fiscal year by the employer.

2. What the furnishing of Form 16A takes place?

A Form 16A is issued quarterly and every 15th of the month following the due date for quarterly TDS return is the due date to issue Form 16A.

3. In what situation does an employer issue Form 16?

An employer issues Form 16 to the employee when he deducts TDS on salary paid to a particular employee.

4. How can Form 16 and Form 16A benefit me?

You can make use of information of TDS and income from Form 16 and Form 16A to issue your income tax return, compute, and pay your tax.