‘Profit and Loss’ is a common term used across various business verticals. It is one of the most basic principles on which every business operates.

This article will discuss the meaning of the profit and loss account and all the important terms associated with it.

What is a Profit and Loss Account

When the revenue of a company exceeds its expenditures, the company is said to be in profit. When the expenditure of a company exceeds its revenue, the company is said to incur a loss. A profit and loss statement calculates the revenues and expenses of a company to show its performance.

A profit and loss (P&L) account is a financial statement that shows the outcome of the various business transactions in an accounting period. The company’s incomes and expenses of a certain period are compiled and used to measure the company’s performance during that period.

The P&L account (P&L a/c) of a company shows its ability to generate sales and manage expenses. It is presented using the cash or accrual accounting method.

A Profit and Loss account is also known as a Profit and Loss Statement, Income Statement, Statement of Financial Results or Income, Expenses Statement, Statement of Operations, and Statement of Earnings.

How Does a Profit and Loss (P&L) Account Work

Every public company has to issue a quarterly and annual financial P&L statement along with a balance sheet and a cash flow statement. The P&L statement is the most common financial statement used to measure the income of a company and the way it is managing its funds.

The main purpose of the profit and loss statement is to check whether a business is making profit or loss over the given financial period. In other words, the profit and loss account of a company shows its efforts in generating income and maintaining its cash flow while running the business.

A Profit and Loss Statement contains all the details of credits, including turnovers, investments, and other incomes and debits, including sales costs, overheads, manufacturing costs, and so on of a business.

Also read about Accounting Vouchers

How Does a Profit and Loss Statement Look

A P&L Statement of a company represents its credits and debits over a certain period, usually quarterly or annually. A P&L statement consists of the following categories:

- Revenue generated (sales)

- Cost of sales

- Selling, General and Administrative (SG&A) expenses

- Marketing costs

- Advertising costs

- Developmental or Research costs

- Interest expenses

- Taxes

- Other incomes

What is a Profit and Loss Account Used For

The P&L A/c of a company is used to determine its income tax and corporation tax. If the P&L statement of a company is incorrect, it may lead to increased penalties and interests.

Profit and Loss statements are also used to study the various market trends and their effects on the company over a period of time. These statements include depreciation and inflation costs so it becomes easier to predict the performance of a sector based on the current value of the currency in the market.

P&L statements are also beneficial to investors and shareholders. They can check the statements to see whether a company has profited or lost more money and make their decisions based on the reports.

What are the Types of Profit and Loss Account

There are three types of profit and loss accounts. Each has a set of golden rules that are followed while compiling the profit and loss statement.

- Personal account

This is a personal account of a person. The person may be a creditor, investor, debtor, or any other person who has a financial dealing with the company.

The golden rules of accounting for this account are that Debit involves the receiver and Credit involves the giver.

- Real account

This account deals with inventory, that is, the buying and selling of goods and services. A company can have several real accounts based on the number of goods and services it deals with.

The golden rules of accounting for this account are that Debit is what comes in and Credit is what goes out.

- Nominal account

This account shows the income or expenditure of a company. These accounts are used to study departmental performances.

The golden rules of accounting for this account are Debit includes expenses and losses and Credit includes incomes and profits.

According to the above categories, a company’s Profit and Loss Statement is drawn.

What are the Different Terms in Profit and Loss Account

Several financial parlances are used while making a P&L statement. Here are some of them:

- Net income:This is the income of the company minus the cost of goods sold, expenses, and taxes.

- Gross profit: This is the company’s total revenue/sales minus the cost of the goods sold.

- Operating profit: This is the profit after deducting operative costs like rent from gross profit. It does not include interest and tax deductions.

- Net profit: This is the amount left over after all the working expenses are deducted from gross profit. It is the company’s actual profit.

What is the Format of a Profit and Loss Statement

A P&L statement is divided into two parts: debit and credit. Here is what a typical statement looks like:

| Profit and Loss Statement | |||||

|---|---|---|---|---|---|

| Dr | Cr | ||||

| Particulars | Amount | Particulars | Amount | ||

| Opening Stock | - - - - - - - - - | Sales Accounts | - - - - - |

||

| XXXX | ---- | Sales | -- -- | ||

| XXXXXXX | ----- | Closing Stock | - - - - - - |

||

| Purchase Accounts | - - - - - - - - - - - | XXXXXXXX | -- -- | ||

| XXXXXXXXXXX | ----- | XXXXXXXXXX | -- -- | ||

| Gross Profit c/o | - - - - - - - - - - - - | -- -- -- -- -- | |||

| 58971200.6 | Gross Profit b/f | - - - - - - - - |

|||

| Indirect Expenses | - - - - - - - - - - - | Indirect Incomes | - - - - |

||

| XXXXX | ---- | -- -- | |||

| XXXXXXX | ----- | -- -- | |||

| Nett Profit | - - - - - - - - - - - - - - - - - | ||||

| Total | - - - - - - - - - | Total | - - - - - - - - - |

In this table, the “Dr” side represents all the debits that the company has incurred including indirect expenses. The “Cr” side represents all the direct and indirect revenues of the company.

What are the Components of a Profit and Loss Account?

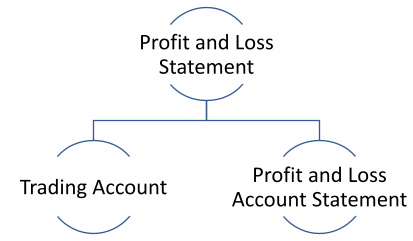

A Profit and Loss Account is divided into two main components:

- Trading Account

- Profit and Loss Account Statement

Trading account

Trading Account is prepared from the point of view of manufacturing or merchandising. This account statement is used to calculate the gross profit or loss of a company. This calculation is important to measure the success of a business. In this account, you have to consider all direct incomes and expenses.

Here are the different components of a trading account:

| Trading Account – Debit Side | |

| Items | Description |

| Opening Stock | Includes the closing balance inventory calculated from the previous financial period. In the case of trading account, only finished goods are included. You can get the opening stock amount from Trial Balance. |

| Purchases | This includes all the purchases made during the year. You have to include all cash and credit purchases. You can deduct purchases withdrawn by the distributor, goods distributed for free, etc. |

| Direct Expenses | This includes all the expenses incurred from the moment a product is acquired to the moment it is converted into a usable product. Expenses such as transportation, packaging, wages, etc. are included here. |

| Gross Profit | If the credit side of the trading account is greater than the debit side, you will have gross profit. |

| Trading Account – Credit Side | |

| Items | Description |

| Sales Revenue | This includes the income earned from various business activities. When the goods or services are sold to the customers, the company earns an income. If there are any returns, they should be deducted from the sales revenue. |

| Closing Stock | This includes the inventory a company has at the end of a financial period. In the case of trading account, the stock of finished goods only should be calculated. |

| Gross Loss | If the debit side of the trading account is greater than the credit side, you will have a gross loss. |

Profit and Loss Account Statement

A Profit and Loss Account Statement is the comprehensive accounting statement of all the transactions carried out by the company during a certain financial period. The various categories in this statement are:

| Profit and Loss Account – Debit Side | |

| Salaries | These include the employment expenses paid to workers and staff |

| Marketing Expenses | Expenses paid for advertising and promotion |

| Depreciation Expenses | Non-cash expenses related to the wear and tear of assets involved in revenue generation. They can decrease the value of assets. |

| Outstanding Expenses | These expenses are the ones that are incurred but not paid yet. |

| Rents | These are the expenses paid for properties and equipment used for your business and royalties paid for patents and trademarks. |

| Operating Costs | Other expenses like repairs and maintenance, property taxes, loan repayments, travel expenses, legal charges, and bank charges. |

| Non-operating Costs | These are one-time expenses made for the business like Preliminary Expenses, Loss on Fire or Theft, etc. |

| Profit and Loss Account – Credit Side | |

| Operating Income | Income earned from core business activities |

| Non-operating Income | One-time income from investments like dividends, interests, gain from asset or property sale, etc. |

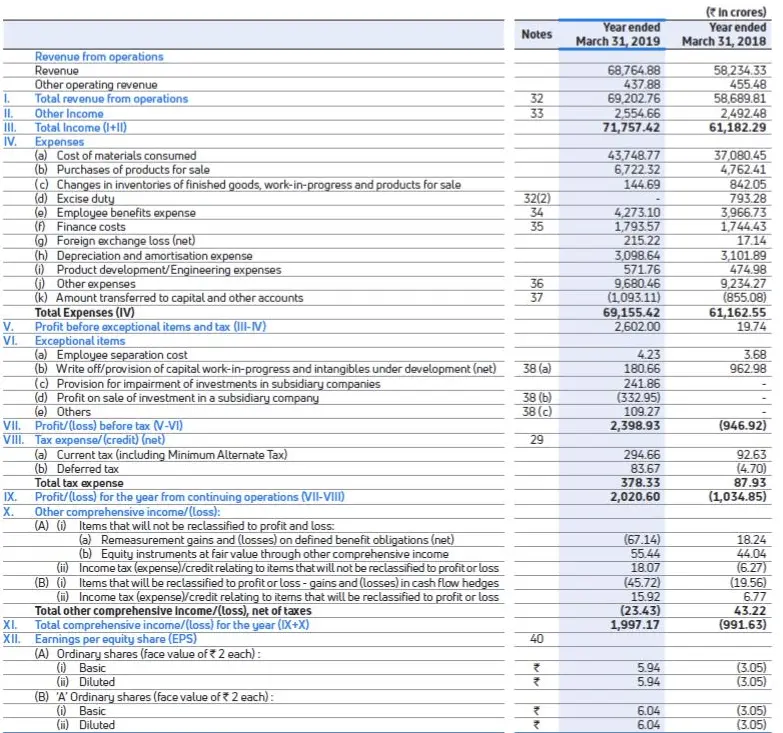

The following is an example of a Profit and Loss Account Statement of Tata Motors for the financial year 2019-20.

Courtesy: Tata Motors

The above example shows the gross profit gained by the direct income after deducting direct expenses. The gross profit is then added to the indirect income to get net profit.

How to Prepare a Profit and Loss Statement?

To prepare a profit and loss statement, several other statements are used.

- Journal: A journal entry is used to record a transaction showing the Debit and Credit accounts and the amounts involved with a short description for each transaction.

- Ledger: A ledger is a T-shaped account with the debit side on the left side and the credit side on the right side. The entries in the journal are included in the ledger accounts. Every account has a separate.

- Trial Balance: A trial balance is a statement that shows debit and credit balances. This list ensures that all the entries have been recorded correctly. The sum of the debits must match the credits.

- Balance Sheets: All the accounts which haven’t been closed are included in the balance sheet. Unlike a profit and loss statement, a balance sheet is prepared on a certain date.

FAQs related to profit and loss account

What happens to the balances of items in the Profit and Loss Account at the end of an accounting period?

The balances are not carried forward to the next accounting period. All the balances are closed and started in every new period.

What is a Receipt and Payments account and is it the same as the Income and Expenditure Account?

A Receipt and Payments account is used by a non-profit organization to show cash flow. On the other hand, an Income and Expenditure Account is prepared on an accrual system which means that even if cash is paid in advance, it will not be an expense until the costs correspond to a product.

Which transactions are not shown in the Profit and Loss Account?

Non-nominal accounts like withdrawal by the proprietor, investments in assets, cash withdrawn, etc., are not included in Profit and Loss Account.

Who can prepare a Trading Account?

A manufacturer or merchant prepares the trading account to show the income from basic business activities.

How can you calculate Profit or Loss through Profit and Loss Account?

The Credit side of P&L a/c represents income and the Debit side represents expenses.

Profit is calculated by the formula (when the Credit side is leading)

Profit = Income – Expense

Loss is calculated by the formula (when the Debit side is leading)

Loss = Expense – Income