It is a taxation method in which the individual or organization who is in charge of making certain payments deducts the necessary tax before crediting the payment to its recipient. TDS stands for Tax Deducted at Source. Salary, bonus, commission, FD interest, and rent are examples of common forms of payments subject to taxation under the TDS method. The Income Tax Act of 1961 specifies the types of payments subject to TDS and the applicable rates.

This article contains a summary of the various TDS rates that will be in effect for the fiscal years 2021-2022 (academic years 2022-2023).

Different TDS Sections

TDS is a sort of spot tax in which the amount is deducted from the source of the income being taxed. There is a provision on indirect taxes in the Income Tax Act 1961 that explains the problem. Interest paid on fixed deposits, employer-provided incentives, commission payments, dividends on bonds, the sale/purchase/rental of real estate, and money received as a prize in a lottery or other award are all instances of financial goods on which it is inferred by the law. Amounts of TDS are levied under several sections and subsections of the Act, with rates ranging from 1 percent to 30 percent.

For many honest taxpayers, one of the most common misconceptions about taxation is that because they get their income or other payment after deduction of Tax at Source (TDS), they are not needed to file an Income Tax return (ITR), presuming that their tax responsibility has been satisfied.

People who have not filed their income tax returns will be subject to TDS at a higher rate than those who have. The rate of TDS will be greater for those who do not have a PAN number on their identification card. According to the Finance Minister’s release of the Union Budget for 2021, this rule will become applicable on July 1, 2021.

In accordance with a particular provision in the Income Tax Act, people who have not filed their income tax returns but whose income is liable for TDS deduction will be charged a greater rate of TDS than those who have filed their returns. The rate of TDS will be twice as high at the indicated rates as it will be at 5 percent.

| IT Section | Threshold Limit* | TDS Rate |

| Section 192 | As per applicable income slab | As per income tax slab rate |

| Section 193 | ₹ 5000 for debenture payment | 10% of the interests earned on security investments. |

| Section 194 | ₹ 2500 | 10% of proceeds from any deemed dividends |

| Section 194A | ₹ 10,000 | 10% of proceeds from interests earned on investments other than securities |

| Section 194B | ₹ 10,000 | 30% of prize money on lottery or gaming-related winnings |

| Section 194BB | ₹ 10,000 | 30% of prize money from horse racing |

| Section 194C | ₹ 30,000 which is for each contract, whereas ₹ 100,000 is for p.a. | Proceeds from any contracts/subcontracts |

| • Individuals or HUF @ 1% | ||

| • Non Individual/corporate @ 2% | ||

| Section 194D | ₹ 15,000 | 5% of earning as insurance commissions |

| Section 194EE | ₹ 2,500 | 20% of expense in NSS deposits |

| Section 194F | NIL | 20% of investment in MF or UTI units |

| Section 194G | ₹ 15,000 | 5% of the commission money from lottery ticket selling. |

| Section 194H | ₹ 15,000 | 5% of the brokerage earnings |

| Section 194I | ₹ 1,80,000 | 2% on rental amount of plant & machinery/ |

| 10% on the rent of land & building | ||

| Section 194J | ₹ 30,000 p.a | 10% on the technical/professional services |

| Section 194LA | ₹ 2,50,000 | 10% on the transfer money paid to any resident while acquiring an immovable property |

*The threshold amount is the maximum amount that is not subject to TDS. The prices listed above are indicative and subject to change upon notification by the government.

TDS Rates for the FY 2021-22

The following is the most recent TDS rate chart valid for the Financial Year 2021-22, as amended by Budget 2021;

| Section | For Payment of | Threshold limit | TDS Rate % |

| 192 | Salary Income | Income Tax Slab | Slab rates (Based on old or new tax regimes) |

| 192 A | EPF – Premature withdrawal | Rs 50,000 | 10% If no Pan, TDS @ 30% |

| 193 | Interest on Securities | Rs. 10,000 | 10% |

| 193 | Interest on Debentures | Rs 5,000 | 10% |

| 194 | Dividend (Dividend other than listed companies) | Rs 5,000 | 10% (No TDS on Div Payouts by REITs / InvITs) |

| 194 A | Interest other than on securities by banks/post office | Rs. 40,000(Rs 50,000 for Senior Citizens) | 10% |

| 194 A | Interest other than on securities by others | Rs. 5,000 | 10% |

| 194 B | Winnings from Lotteries / Puzzle / Game | Rs. 10,000 | 30% |

| 194 BB | Winnings from Horse Race | Rs. 10,000 | 30% |

| 194 D | Payment of Insurance Commission (Form 15G/H can be submitted) | Rs. 15,000 | 5% (Individuals) |

| 10% (Companies) | |||

| 194DA | Payment in respect of Life Insurance Policy | Rs 1,00,000 | 5% |

| 194E | Payment to non-resident sportsmen/sports association | – | 20% |

| 194 EE | Payment of NSS Deposits | Rs 2,500 | 10% |

| 194 G | Commission on Sale of Lottery tickets | Rs 15,000 | 5% |

| 194 H | Commission or Brokerage | Rs 15,000 | 5% |

| 194 I | Rent of Land, Building, or Furniture | Rs. 2,40,000 | 10% |

| 194I | Rent of Plant & Machinery | Rs. 2,40,000 | 2% |

| 194 IB | Rent (Tenant has to deduct TDS) (Individuals who are not liable to Tax Audit) | Rs 50,000 (per month) | 5% |

| 194 IA | Transfer of Immovable Property, other than Agricultural land | Rs. 50 lakh | 1% |

| 194IC | Payment of monetary consideration under Joint Development Agreements | – | 10% |

| 194J | Fees for professional or technical services | Rs 30,000 | 2% (or) 10% |

| 194LA | Payment of compensation on acquisition of certain immovable property | Rs 2,50,000 | 10% |

| 194 LB | Interest from Infrastructure Bond to NRI | NA | 5% |

| 194 LD | Interest in certain bonds and govt. Securities | NA | 5% |

| 194N | Cash withdrawal during the previous year from one or more account maintained by a person with a banking company, co-operative society engaged in the business of banking, or a post office: | >Rs 1cr | 2% |

| 194Q | Purchase of goods (applicable w.e.f 01.07.2021) | Rs 50 lakh | 0.10% |

| 206AB | TDS on non-filers of ITR at higher rates (applicable w.e.f 01.07.2021) | – | 5% or Twice the rates in force |

| 194P | TDS on Senior Citizen above 75 Years (No ITR filing cases) | – | Slab Rates |

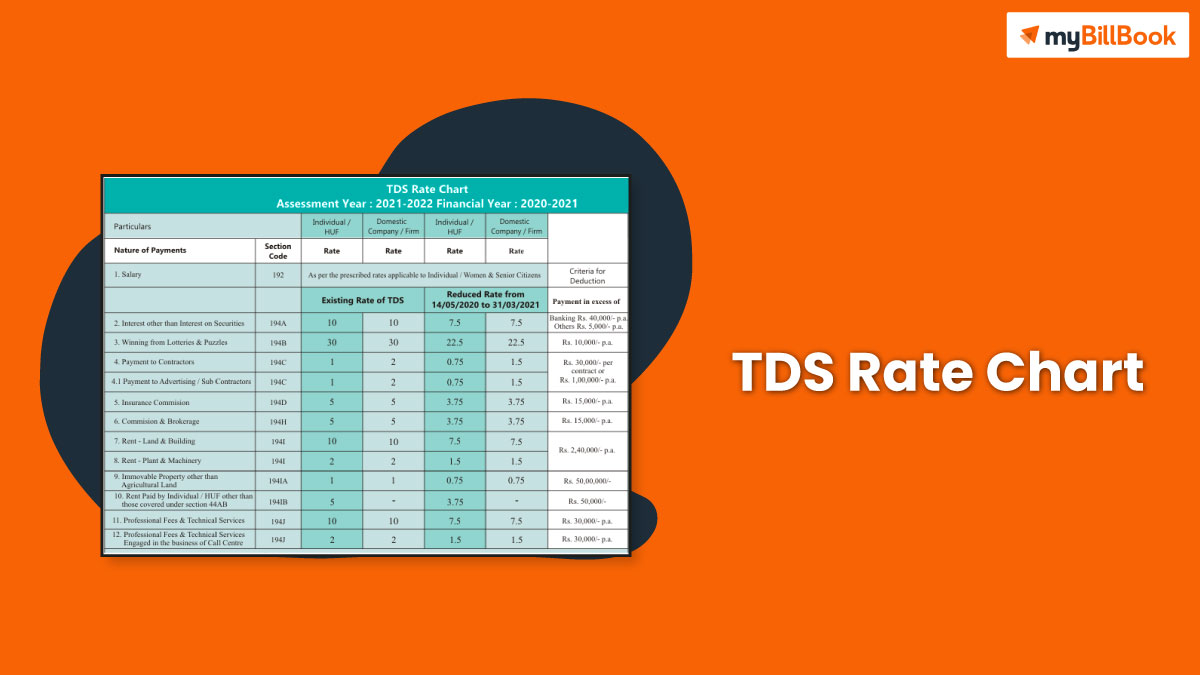

Difference between TDS Rate Chart for FY 2020-21 and FY 2021-22

Given the outbreak and consequent lockdown that affected all sectors of the economy, the Government of India reduced the rates of Tax Deducted at Source and Tax Collected at Source on several transactions by 25 percent from 14th May 2020 to 31st March 2021 for a limited period.

The government has reduced the TDS rates for the period 14.05.2020 to 31.03.2021. As a result, we have different TDS rates for the fiscal years 2020-21 up until the 14th of May, 2021 and from the 14th of May, 2020.

The government stipulated lower TDS rates in the “Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020.” In cases where the provisions of Sections 193, 194, 194A, 194C, 194D, 194DA,194EE, 194F, 194G, 194H, 194-I, 194-IA, 194-IB, 194-IC, 194J, 194K,194LA, sub-section (1) of Section 194LBA, clause I of Section 194LBB, sub-section (1) of Section 194LBC, sections 19

It was only until the 31st of March in 2021 that these reduced TDS rates were in effect. As a result, existing TDS rates (before the 14th of May, 2020) would be applicable starting on April 1, 2021.