What is TAN full form?

Full form of TAN is Tax Deduction and Collection Number .

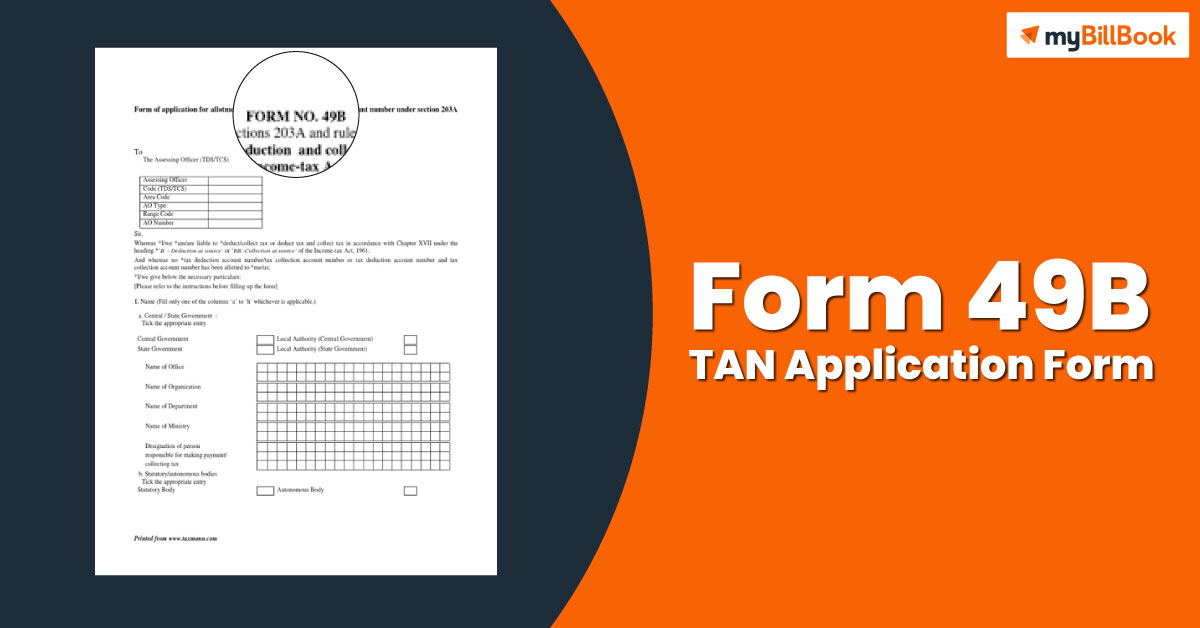

What is TAN Application Form 49B

Form 49B is the application individuals can use to apply for a new Tax Deduction and Collection Number (TAN). The form is available at any TIN facilitation centre for receiving e-TDS returns. A new TAN application, Form 49B, can be made by visiting the Income Tax department or creating an online application at the Income Tax official website.

Types of TAN Application

Applications for allotment and applications for change are the two categories of TAN applications.

Applications for allotment of new TAN are available on nsdl website, or one can download them to submit offline. The processing fee is Rs. 55 + 18 % GST.

Applications for change or correction of TAN have a processing fee of Rs. 63 + service tax. For this, details like 10-digit TAN number, address, nationality, and PAN details are necessary.

Guidelines For Filling Application Form 49B

The applicant must carefully complete Form 49B, which contains many sections, for the TAN application to be accepted.

Following are some considerations the applicant should make when filling out Form 49B:

- Form 49B must only be filled out in capital letters in English to make the entries readable.

- The tax deductor or collector must provide information about the assessing officer. You can get these facts from the Income Tax Office if they are unavailable.

- Every text field on the form should have one letter entered for easier reading and comprehension.

- The tax collector or deductor must additionally provide information about the region, area code, district, etc. Before filling out Form 49B, the Income Tax Office can be contacted to get more information.

- A gazetted officer, a notary, or magistrate must certify the signature if the form is signed with the left-hand thumbprint.

- The left thumb impression is only accepted from applicants for TAN. The acknowledgement form printed must be signed by applicants who fall under another “category of deductors.”

- Complete the fields on Form 49B. Any portions that are left empty or unfinished are not taken into account.

- The individual in charge of tax filing and submission must set down their title.

- The applicant must provide a valid Indian address.

The Income Tax Department checks the information after form 49B has been completed and submitted. If the application appears complete and accurate, Protean eGov Technologies Limited will notify the applicant of the new TAN information at the address listed on Form 49B or, if the application was submitted online, by email.

Tan acknowledgement slip

The acknowledgement slip must be provided to Protean eGov Technologies Limited after the TAN application has been filed successfully. The duly executed acknowledgement slip should be sent to:

Protean eGov Technologies Limited

5th Floor, Mantri Sterling

Plot No.341, Survey No.997/8,

Model Colony, Near Deep Bungalow Chowk, Pune – 411016

Protean eGov Technologies Limited must receive the acknowledgement slip and required documents within 15 days of the online application. TAN application processing will only begin after receipt of the signed acknowledgement and payment is confirmed.

Payment For Availing TAN

To apply for a new TAN, applicants must pay Rs.65 (Rs.55 application charge + 18% of Goods and Services Tax).

The applicant can make the payment through any of the following modes:

- Demand draft

- Cheque

- Credit card/Debit card

- Online banking

Required Documents for TAN Application

When submitting a TAN application, the applicant is not needed to provide any supporting documentation. If they submit their request for a new TAN online, they only need to include the acknowledgement slip and the demand draft.

Contact TDS

The following ways can be used to contact Protean eGov Technologies Limited representatives for more information:

- Dial 020-27218080 for PAN/TDS Call Centre or 020-27218081 for faxes.

- Send an email to tininfo@nsdl.co.in.

- To find out the status of the TAN application, SMS the NSDLTANacknowledgement number to 57575.

- Write to: Protean eGov Technologies Limited, Fifth Floor, Mantri Sterling, Plot 341, Survey 997/8, Model Colony Near Deep Bungalow Chowk, Pune 411016

FAQs about TAN application Form 49B

Who Allots TAN?

The Income Tax Department issues TANs following applications made to TIN Facilitation Centres run by NSDL.

How do you get a TAN form?

Go to https://tin.tin.nsdl.com/tan/index.html and choose "Online Application for TAN (Form 49B)"

Which form is required to apply for TAN?

To apply for a new TAN, individuals must utilise Form 49B.

Can TAN be applied online?

Yes, an individual can apply for TAN online as well as offline.

How do I download form 49B?

Form 49B A PDF version of the TAN Number application form is available on the NSDL's official website, nsdl.co.in.

Can I apply for TAN without PAN?

Yes, you can apply for TAN without PAN.

Are TAN and PAN the same?

PAN, or a Permanent Account Number, is given to taxpayers while TAN is given to tax-deductors.

What is the payment for availing of a TAN and what are the modes of payment via which one can pay?

There is a fee of INR 65 (INR 55 + 18% GST) that one needs to pay for when availing of a TAN Form 49B. The payment can be made Demand Draft, Cheque, Net Banking and Debit or Credit Cards.

What is the penalty for not applying and having a TAN application?

In case an individual is subject to TDS or TDS return they need to have a TAN. If an individual or business does not have a Tax Deduction and Collection Account Number they can be subject to a penalty and fine of INR 10,000.

Can one file for a TAN application online as well as offline?

Yes. TAN Application Form 49B can be applied online as well as offline. In case one decides to go via the online route then the acknowledgement form needs to be posted to NSDL. In case one decides to choose the offline route, they need to go to a TIN facility in their local area of residency and ensure the form is filled and submitted.

What are the documents required for applying for a TAN application Form 49B?

No documents are required when applying for a Tax Deduction and Collection Account Number.