ITR 5 means a type of form which needs to fill for the income tax return. But this is not for any individual or HUFs. More details regarding who is eligible to file ITR-5or ITR 5 for whom can be seen below. In order to furnish ITR form 5, the assessee must follow several mandatory provisions. E-filing of returns is compulsory. If the entity requires its books of accounts audited to verify its income tax return in ITR Form 5, a digital signature is required. E-verification by Aadhar OTP, E-verification by producing EVC, and mailing a signed copy of ITR-V to CPC, Bengaluru are other alternatives for verification. Peruse the details below to understand more about how to file the ITR 5 online.

What is ITR 5 and Who is Eligible to File ITR 5?

ITR 5 is the income tax return which is applicable for forms, AOPs, LLPs, BOIs, Artificial Juridical Person, Estate of deceased, Estate of Insolvent, Business Trust and investment fund. Other people who are required to file the return of income under section 139(4A), 139(4B), 139(4C), or 139 (4D) cannot sue this ITR-5 form.

How to Download ITR 5?

You can easily download the ITR 5 form online from the official website of the Income Tax Department. After the income tax return is filed online, the Income Tax Department will send the ITR- V to the registered email id which is available in their database according to the PAN. If you want to download the ITR- V, follow the steps given below.

- Step 1 – Click on this link https://incometaxindiaefiling.gov.in/ to open the website of the income tax department. Then click on the Login button if you have an account or click on the Register Yourself button to generate a new account.

- Step 2 – Enter your login credentials to access your account

- Step 3 – Click on e-Filed Return/Form which you can find under the My Account section

- Step 4 – Then you must select an option from the drop-down menu given. So, select the Income Tax Return option and click on Submit button

- Step 5 – You must click on the Ack.No which will open the option to download ITR – V or the Acknowledgement to get your ITR- V. Your password for ITR-V will be a combination of PAN in lowercase and your Date of Birth (DDMMYYYY). For example, if your PAN number is AAAXX1213A and your date of birth is 23/11/1984, then your password will be aaaxxx1213a23111984.

Your responsibilities don’t end when you file your tax return. You must guarantee that the verification is completed and that the progress of your tax return is monitored. You’ll be better prepared to update, modify, or explain your tax return if it needs to be updated, modified, or explained. To complete the process, you must print the ITR-V form, sign it and post it to CPC, Bangalore. You can find the address to send the form under the ITR-V form. It is also possible to e-verify your ITR-V form online as well. To verify ITR 5 you can select any of the following options.

- The verification form of the income tax return form has a digital signature. Taxpayers whose accounts are required to be audited under section 44AB are required to validate their information electronically using a digital signature.

- Use Aadhaar OTP

- The use of an electronic verification code allows for authentication – EVC

- Send CPC, Bangalore, a duly signed copy of the ITR acknowledgement. Within 120 days of the date of e-filing the return, the Form ITR-V-Income Tax Return Verification Form should arrive. The ITR-V will be received at the Centralized Processing Centre, and the Income Tax Department will send a confirmation. The confirmation would be delivered to the assessee’s e-filing account’s registered e-mail address.

Anybody who files the income tax return must print two copies of the ITR-V form when filing a return. The assessee signs one of the copies and mails it to Post Bag No. 1, Electronic City Office, Bengaluru–560500 (Karnataka). He or she should keep one for themselves as a record.

How to File ITR 5?

It is important to file ITR 5 on or before the due date of filing the income tax return. ITR 5 can be filed online on the e-filing portal of the income tax department. It is not possible to file this form in paper form. You can either file the ITR 5 online or submit or you can fill the excel/Java utility and then submit it.

Steps to prepare the ITR 5 online

- Open he Income Tax Department website and log in to your account with the username and password. Here is the link to open the official website – www.incometax.gov.in.

- You can find the option Filing of Income Tax Return under the dashboard. Then select the Prepare and Submit Online option.

- Ensure the prefilled details are correct and fill in the rest of the details for the income tax return.

- You must save every schedule and click on the continue button

- After filling in the details submit the form.

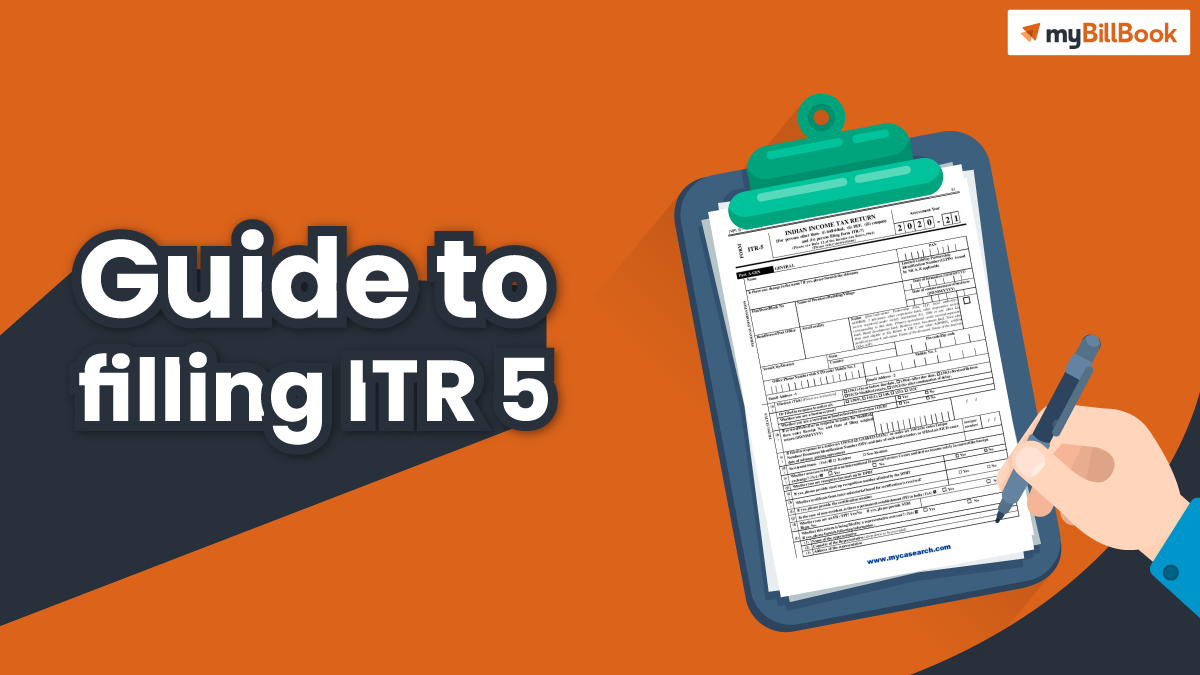

- Be aware that when submitting with ITR Form 5, no supplementary papers are required to be attached to the return. Any other documents that are attached to the form will be removed and returned to the person who is filing the return. With their Tax Credit Statement Form 26AS, taxpayers only need to match all of the tax deductions, collected, or paid.

Steps to fill the details in Excel/Java Utility for ITR 5

To submit the utility online, you must first download it from the website and then fill out the required information. The steps outlined here will assist you in filling up the details in an excel or Java utility.

- To open the website in your browser, you must click this link

- You must select the assessment year for which you are filing the income tax return

- You can either download an excel or the java utility

- When you select the download option, the application will be downloaded as a ZIP file in compressed mode to your computer

- Extract the ZIP file and open the utility and fill in the details required

- You must fill, save and validate each section of the utility

- After filling in all the details accurately, you have to submit it online by logging in to your income tax e- filing account

- To submit, click on the Dashboard and select the Filing of Income Tax Return option

- Select the assessment year and upload the utility

- Click on Submit button.

FAQs on ITR 5

- Who cannot file ITR 5 form?

Ans: This type of income come tax return cannot be filed by an individual, company, HUFs, and those who file income tax returns in ITR form 7.

- Is it mandatory to fill the ITR form for income tax returns?

Ans: Yes, it is mandatory to fill in ITR forms to state the information of the taxpayer and his/her tax liabilities and deductions.

- Who is required to furnish ITR 5 form?

Ans: ITR form 5 should be furnished by firms, Association Of Person (AOPs), Body Of Individuals (BOIs), Artificial Juridical Person (AJP), Estate of deceased, Estate of insolvent, Business Tryst and Investment Fund, Limited Liability Partnerships( LLPs), Cooperative societies and Local authority.