With India continuously emerging as one of the fastest-growing economies in the world, the government has taken several steps to help small and medium-scale enterprises (MSME) flourish and grow. One such step is setting up a dedicated portal for MSME registration in India. The portal helps budding entrepreneurs to register their businesses and get the benefits set by the government.

Even though the Indian government has not yet made MSME registration mandatory, it is still beneficial because it offers numerous advantages in terms of taxation, business setup, credit options, loans, and other financial services.

In case you have just started your own business and are in the process of registering it, here is an all-inclusive guide on MSME registration in India.

What do you mean by MSME Classification?

Initially, MSME organisations providing goods and services were classified based on their investment. Here are the details of the previous MSME classification:

| Business Sector | Micro | Small | Medium |

| Manufacturing | < Rs. 25 lakh | < Rs. 5 cr | < Rs. 10 cr |

| Services | < Rs. 10 lakh | < Rs. 2 cr | < Rs. 5 cr |

The companies were having difficulties with the old MSME classification. Due to their inability to expand their businesses, the Aatmanirbhar Bharat Abhiyan (ABA) revised the MSME classification by adding composite criteria that considered annual turnover and investment.

New MSME classification

The revised MSME definition eliminated the distinction between the manufacturing and services sectors. The classification of an MSME according to the most recent revision, which considers both investment and annual turnover, is as follows.

| Sector | Micro | Small | Medium |

| Total Annual Investment & Turnover | < Rs. 1 cr & < Rs. 5 cr | < Rs. 10 cr & < Rs. 50 cr | < Rs. 50 cr & < Rs. 250 cr |

As per the previous guidelines, the MSME classification covered only the manufacturing and service industries, but in July 2021, it was decided that wholesale and retail trade would come under the umbrella of registered MSMEs.

However, particular areas (such as auto sales) are still outside this classification. If a company is involved in trade, regardless of sector, it can register as an MSME. Retail and wholesale trade, as well as the manufacturing and service sectors, are all included and may apply for MSME registration.

MSME Online Registration Process on Udyam

The process of MSME registration is online and is managed through the government portal udyamregistration.gov.in. MSMEs can register on the portal under either of the two categories:

- New business owners who have EM-II and are not yet registered as MSME

- Businesses already registered as UAM and those who have done so through Assisted filing.

Registration For Entrepreneurs Already Having UAM

Businesses registered as UAM must click the button labelled “For those who have already registered as UAM” or “For those who have already registered as UAM through Assisted filing” displayed on the government portal’s home page.

After clicking, a new page will appear where you can enter your Udyog Aadhaar number and choose an OTP option.

Now, businesses have 2 choices to get an OTP- through mobile number or email address.

After choosing your OTP options, follow the link “Validate and Generate OTP.”Once the OTP process is complete, registration information on the MSME registration form must be filled out, and Udyam registration is complete.

Details to Include in the MSME Application Form

The business owners must provide the following information on the MSME application form:

- PAN Card

- Gender

- Individual Category such as General, OBC, SC/ST

- Aadhar Card

- Name of the business owner as per Aadhar Card

- Name of the company

- Address of the company’s office

- Date of business start-up, company incorporation, or business registration

- Details of the organisation type (Proprietorship, partnership firm, private or public limited company, limited liability partnership, co-operative society, Hindu undivided family, self-help group, society or trust)

- IFSC code and bank account number

- Enterprise business activity

- NIC code for the main activity

- Employee count

- Location of the plant/unit

- Amount invested in equipment and plants(Entrepreneurs may enter zero as an investment in plant and equipment if there is none)

- Revenue(If there is no revenue, owners can mention it as zero)

Documents Required for MSME Registration

- PAN Card

- Aadhar Card

Since the MSME registration process is online, the Udyam Registration Portal will automatically pull PAN and GST-linked information on the investment and turnover of businesses from the government databases. GSTIN and Income Tax systems are completely integrated with the Udyam Registration Portal.

MSME Registration Fees

Here are the details regarding MSME registration fees:

By June 30, 2022, all businesses with UAM registrations must switch to Udyam Registration. The UAM registration is invalid and the entrepreneurs will not be eligible to receive the benefits offered to MSMEs if they do not migrate to Udyam Registration by June 30, 2022. To be eligible for MSME benefits, they must re-register for Udyam registration.

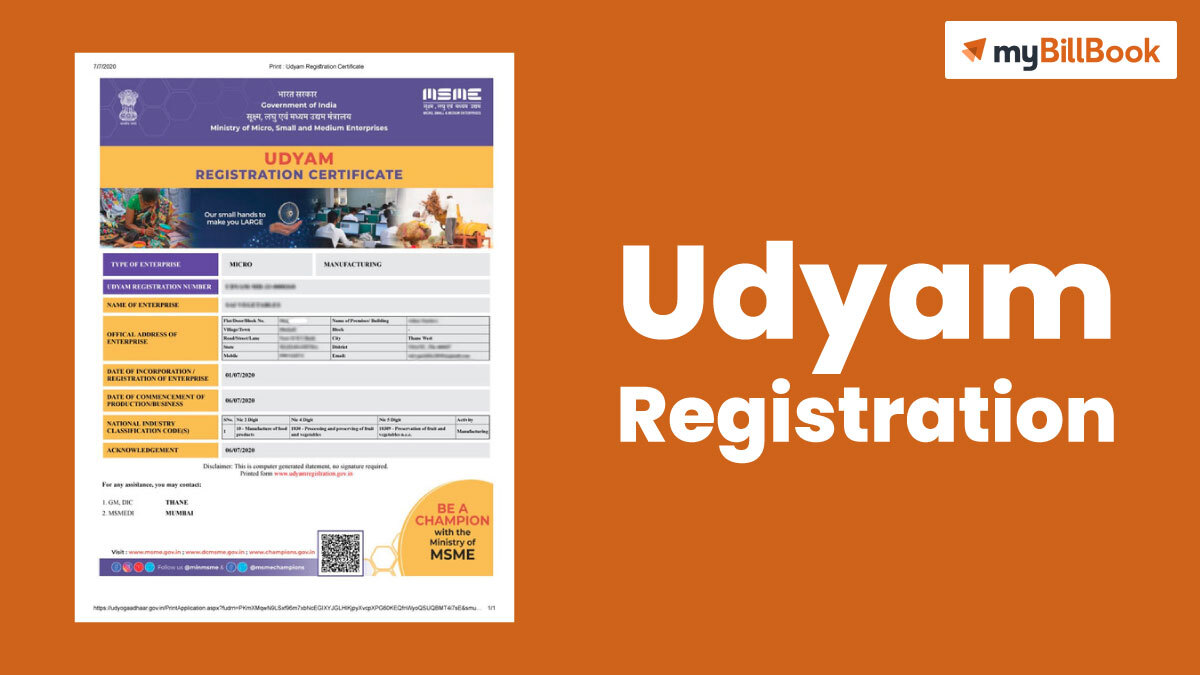

MSME Registration Certificate

Here’s how you will receive an MSME registration certificate:

- After submitting the MSME registration form online, a confirmation message with a reference number will be sent to the email address.

- Upon verification of the registration form submitted on the portal, the Ministry of MSME will issue the Udyam Registration certificate or MSME certificate to your business email address.

- Following the submission of the registration form, the Ministry will issue the MSME certificate. The MSME registration certificate is valid for a lifetime, so business owners don’t have to worry about renewing it.

How to Get MSME Certificate Online

An entrepreneur needs to access the Udyam Registration portal to download the MSME certificate online.

The below steps helps businesses get the MSME certificate:

- After visiting the homepage, there is a ‘Print/Verify’ tab; click on ‘Print Udyam Certificate’.

- On clicking, the business owner has to fill in the details such as Udyam Registration Number and mobile number.

- Select the OTP option and click on the ‘Validate and Generate OTP’ button.

- Enter the OTP sent to your mobile device or email address to validate the OTP and print it.

The MSME registration certificate will show up, and you can print it directly from the page. The reference number provided after submitting the MSME registration form allows an entrepreneur to verify the MSME registration number.

A business owner must select the “Verify Udyam Registration Number” option on the homepage’s “Print/Verify” tab to obtain the MSME registration number. The business owners must enter the reference number and captcha code and click the “Verify” button on the newly opened page. The MSME’s information will be displayed on the screen along with its registration number.

How do I locate my MSME UAN number?

Here are the steps you need to follow:

- Visit https://unifiedportal-mem.epfindia.gov.in/memberinterface.

- Select the link that reads “Know your UAN status.”

- The authorization pin will be sent to your mobile number when you click “Get Authorization Pin.”

- Enter the received OTP.

- After entering the OTP, the message “Your UAN has been sent to your registered mobile number” will be shown.

MSME Helpline Number

| Category | Helpline Number |

| General Enquiries | 011-23063288 |

| Administration questions relating to Udyam Registration or Udyam Registration Certificate | 011-23062354 |

| MSME contact information | Udyog Bhawan, Rafi Marg, New Delhi, India 110011 is the Ministry of Micro, Small and Medium Enterprises address. |

| Technical questions relating to Udyam Registration or Udyam Registration Certificate | 011-23062354 |

| Web information manager for MSME | Udyog Bhawan, Room No. 468 C, Rafi Marg, New Delhi, India 110011 is the Ministry of Micro, Small and Medium Enterprises address. Email: mayapandey.dgca@gov.in. |

Advantages of MSME Registration for Small Businesses

Below are the benefits of MSME Registration:

- Collateral-free loans and low-interest rates compared to the market rates.

- You are leveraged to 1% interest on Overdraft as an SME business owner.

- For MSME business owners, obtaining a business licence and government certificate is much easier. For instance, if you have applied for ISO certification, the government can reimburse the amount you paid.

- Sometimes, government tenders are only available to organisations that have completed their MSME registration. This opens more business opportunities for small-scale business owners.

- More discounts: If you plan to file a patent for your innovation and technology, the government provides you with 50% OFF without any promo code.

- MSME registration helps you get protection against delayed payments. For instance, if a customer purchases goods from you, he has to pay the amount between 15- 45 days. In case of delays, the customer must pay a compound interest along with the amount of the goods.

- It enables you to receive electricity bill discounts. If your business is an MSME, you can apply for some leverage.

MSME Schemes Launched by the Government

Some of the schemes are as follows:

- Udyog Aadhaar Memorandum Scheme: MSMEs can quickly access available loans for MSMEs, credit, and government subsidies under the Udyog Aadhaar memorandum scheme.

- Zero defect Zero effect: The government ensures that products made by MSMEs adhere to specific standards and are not returned to India under this initiative. The scheme, also known as the ZED, helps MSMEs get discounts and benefits for their exported goods.

- Quality management standards and technology tools: This initiative helps raise awareness of the importance of quality in MSMEs’ produced goods. It promotes healthy competition between various businesses to ensure better product production.

- Women entrepreneurship: This program aims to support and inspire women who want to develop something or grow by starting their businesses. Here, the government assists women in managing their businesses more effectively by offering them financial aid, counselling, and training.

- Credit-linked capital subsidy scheme: registered MSMEs may access funds to upgrade their businesses with new technology and replace outdated equipment. MSMEs can speak with banks directly to benefit from this scheme.

- Grievance monitoring system: This initiative was implemented to track and address grievances and suggestions from businesses and MSME owners.

How to register an MSME without an Aadhaar Card?

The applicant who does not possess an Aadhaar card following section 3 of the act has to follow the below process.

- The relevant DIC or MSME-DE must submit UAM registration for the enterprise or business until the individual receives the Aadhaar.

- The individual can instead present the following documents for identification in the meantime:

- Copy of Aadhaar enrollment

- Any of the subsequent Voter identification, a passport, a driver’s licence, a PAN card, a work ID, and a bank passbook

- Copy of the Aadhaar enrolment request

FAQs on MSME Registration

Does MSME allow online registration?

Yes, businesses must register online on the "Udyog Aadhaar Memorandum (UAM) portal" to receive government-announced benefits for MSMEs. The registration process is straightforward and cost-free for all users.

When does the MSME certificate expire?

The MSME certificate is valid as long as the business is open for business. However, a provisional MSME certificate has a 5-year expiration.

Who is qualified to submit an MSME registration application?

The following entities can obtain MSME registration if they meet the updated MSME classification criteria for annual turnover and investment:

- Individuals, small businesses, entrepreneurs, and startups

- Co-operative societies

- Trusts

- Both public and private limited companies

- Limited Liability Partnerships and sole proprietorships (LLPs)

- Self-help groups(SHGs)

Can I register a second MSME after I've already registered one?

The business owner may apply for MSME registration if the enterprises are distinct, i.e., established under different names and registered or incorporated separately.

An organisation cannot submit applications for more than one Udyam Registration.

When completing the MSME registration form, whose Aadhaar number must be entered?

If a company is involved, the authorised signatory must enter the PAN and the Aadhaar number when completing the MSME registration.

How can I verify that my MSME is registered?

You will receive a registration number after successfully registering, and you must keep it handy for future use. It typically takes 2-3 days for the full approval and registration process to be finished after submitting your form.