Proforma invoices are an essential document for every business. Businesses negotiate on various aspects, such as the sale price, rebates, delivery time, etc., before selling or buying. It helps sellers send a draft of an invoice to the buyer indicating what will be delivered. This document acts as a preliminary record of the sale. In this article, we will discuss proforma invoices in detail.

What is Proforma Invoice | Meaning of Proforma Invoice

A proforma invoice details the goods or services that will be delivered to the buyer. It also discloses estimated prices of the available goods or services. Additionally, it estimates commissions and applicable taxes like GST, shipment weight, shipping costs, etc. A supplier issues this invoice in response to an interested customer.

Proforma Invoice Vs. Invoice | Difference between Proforma Invoice and Invoice

A proforma invoice is a document that provides information about the goods or services that have yet to be delivered to the final consumer. Conversely, an Invoice refers to a commercial bill given by the seller to the customer, showing what goods and/or services have been provided, their total price along with tax, and the payment due date.

A proforma invoice is issued before order placement, while an invoice is issued when work has been ordered or goods have been ordered/delivered/fulfilled.

A Proforma invoice is a non-legally binding courtesy for helping buyers know what they should expect (for example, in international importation and trade). In contrast, Invoices are legally binding ways sellers can inform their buyers about amounts due for goods and services already provided.

Proforma invoices include all the information you would find on a standard invoice (name, address, etc.) but must be marked as such and should not be considered invoices. On the other hand, invoices include both companies’ logos, contact details, billing addresses, details of an official order number and a terms and conditions section.

Why do Businesses use Proforma Invoices?

Here is why businesses should use this document:

- To inform the buyer about what to expect from a supplier and invite negotiation

- To show that the seller is willing to provide goods or services at an agreed price on a specified date

- It acknowledges the buyer’s commitment to pay

- To make the quote-to-cash process smoother

- As an internal purchase approval protocol for procuring goods

- To save time and money spent on processing,

- To provide an estimated sale price of undelivered goods or services.

- This will enable customers to understand what is enclosed, the worth of the products shipped, and the shipping time frame, among other things.

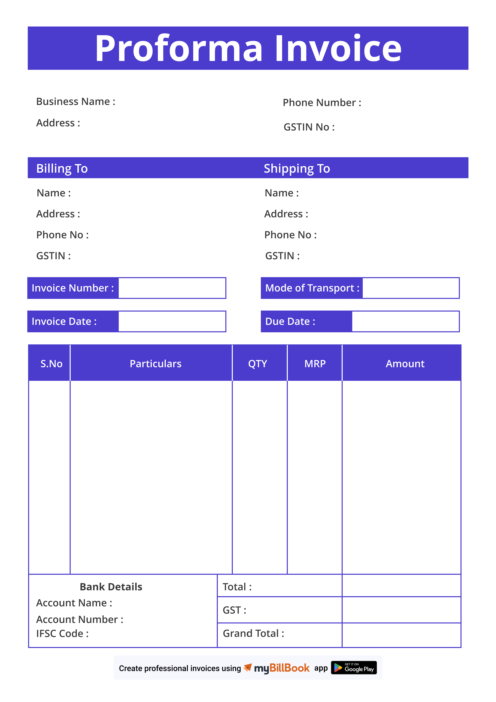

Proforma Invoice Format or Template

Proforma Invoice Format are standard and pre-designed formats that can be used to create Proforma Invoices. They serve as documents that are ready-made and can be easily filled out by businesses to produce these Invoices instantly and consistently. The template includes predefined sections and fields, including the seller’s details, buyer’s details, description of goods/services, quantities, prices, payment terms, etc. These templates may have customisation options such as adding company logos and colours.

Proforma Invoice Format – Fields to Include

A pro forma invoice format should include the following information:

- Invoice number

- Date of issue

- Supplier address

- Buyer address

- Description of goods or services

- Quantity and price of goods

- Validity

- Terms and conditions

- Discounts

- Taxes

- Total

Proforma Invoice Sample

There are no standard industry guidelines for the format of a proforma invoice, and it might look like a sales invoice. Nevertheless, businesses must have a standard proforma invoice format to make it uniform in all business transactions. Here is a sample format or template for your reference.

How to Make Proforma Invoice using myBillBook Proforma Invoice Software?

There are several steps involved in ‘How to make proforma invoice using myBillBook’:

- Visit myBillBook website and sign in to your account with your login details.

- Locate the proforma invoice option on the dashboard

- Fill in your business details: enter your company name, address, contact information and logo.

- Enter customer information such as customer’s name, address, contact information and other relevant details.

- Add items or services to the proforma with their quantities, prices and other relevant details.

- Next, include taxes plus discounts (if any).

- Finally, review & save the Pro-forma invoice

- Download and print.

FAQs

Is the proforma invoice a valid document?

Yes, it is a valid document that gives a detailed breakdown of goods or services on sale before the purchase occurs. It acts as a preliminary bill that sets out the conditions of sale, including price, quantity, and any other relevant details.

Can a proforma invoice be used as an invoice?

It is not an accounting or payment instrument, as it does not constitute a formal payment request. It is a preliminary document given before the goods or services are delivered to the buyer. A quotation of expenses that includes amounts and terms of goods or services. Hence, this cannot be used as an invoice that is more detailed and legally binding.

Who issues proforma invoices?

A Proforma Invoice is issued by the supplier before the real sales occur. Generally, it’s issued to inform the buyer about an upcoming sale and invite necessary negotiation.

Is the proforma invoice valid for payment?

A proforma invoice is not a formal invoice. It comprehensively lists all transaction details and estimates costs. However, it cannot be used to request payment. Ideally, the seller should wait until the buyer issues a commercial invoice to make the payment. However, an advance payment can be made after receiving the pro forma if the buyer agrees to every detail mentioned in it.

Can a proforma invoice be cancelled?

Yes, it can be cancelled as they are not binding documents under the law; they are quotes or estimates given by sellers before the final transaction occurs. As this does not amount to a completed sales contract, a buyer one change the terms of deal or even cancel if he is no longer interested in proceeding with such transactions.

Is the proforma invoice legally binding?

Proforma Invoice is not legally binding. It is similar to a quotation document; the seller does not have much hassle if he or she wishes to cancel it and sales have not occurred. i.e., despite allowing for a proforma invoice as recommended, the purchaser can still change his mind and cancel.

How do you generate proforma invoices online?

Proforma invoice can be generated using different methods -

Using free proforma invoice formats or templates available online

Using online free proforma invoice generators

Using billing software.