Basic rules of the Income Tax Act’s Section 194C

According to Section 194C, the following individuals are held financially liable for paying the resident contractor any amount for performing any work (including the supply of labour):

The individual’s list consists of

- Any local authority

- Federal government or a state government

- Any company or co-operative society

- Any corporation created by or operating following a Central, State, or Provisional Act

- A specific organisation established in India by or according to the provisions of any law is tasked with either addressing and meeting housing accommodation needs, planning, developing, or improving cities, towns, and villages, or both.

- Any society that has been authorised to operate under the Society Registration Act of 1980 or law in any region of India has the same purpose.

- Trusts

- University or any deemed university

- Any business

The authorities have also defined the term “work” in Section 194C. Here are the details:

- Transportation of passengers or goods other than by train

- Advertising

- Telecasting and broadcasting (which also includes producing programmes for such telecasting or broadcasting)

- Catering- using materials purchased from the customer to manufacture or supply a product that meets the requirements and specifications of the customer.

The exception is when the material is acquired from a source other than the customer.

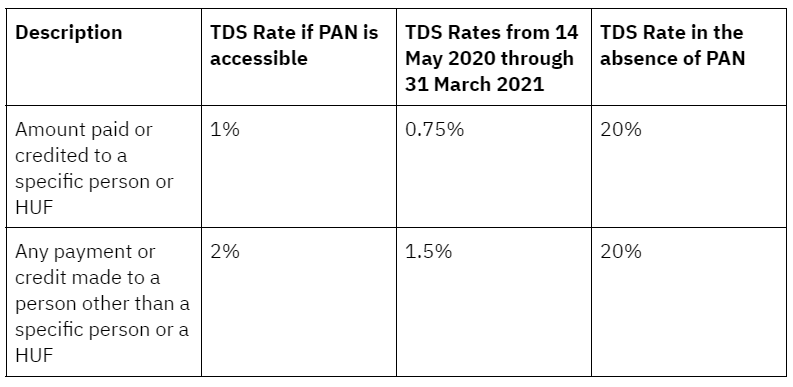

Rate of TDS u/s 194C

The Deductor must deduct TDS at the following rates when the provisions of Section 194C of the Income Tax Act are drawn:

List of exceptions, i.e., cases wherein TDS is not to be deducted u/s 194C

TDS is not required to be taken into account in the following situations:

- The total amount paid or credited for the fiscal year should not exceed INR 1,000,000.

- The sum paid to or credited to the account of a contractor engaged in the business of hiring, plying, or leasing goods carriage, where the Contractor did not own more than 10 goods carriage at any point in the prior year. The declaration must be given to the Deductor along with the PAN by the Contractor.

- A contractor may not receive more than INR 30,000 in payments or credits in a single contract.

- When the Contractor receives payment or credit from an individual or HUF for work done purely for personal use.

Time of deduction of TDS u/s 194C

If the provisions of Section 194C of the Income Tax Act require the Deductor to deduct TDS, the Deductor must do so by the earliest date possible between the following dates:

- When money is credited to the contractor’s account

- When making a payment in cash, by check, draft, or any other method.

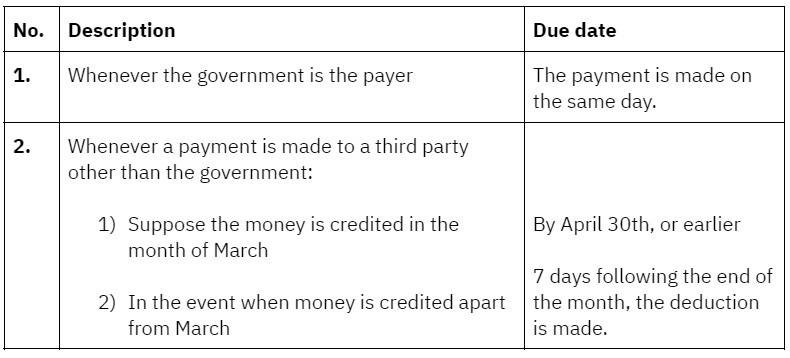

Due date of deposit of TDS u/s 194C

Issuance of TDS certificate u/s 194C

According to rule 31, each person responsible for deducting tax from payments other than salaries must submit a quarterly TDS certificate in Form No. 16A. TDS certificates in Form No. 16A must be issued quarterly for payments other than salary.

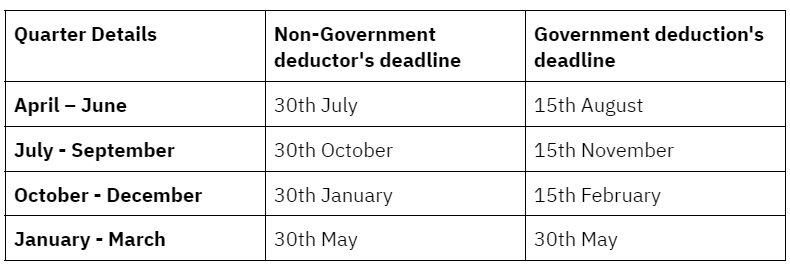

The certificate will be given on the following dates:

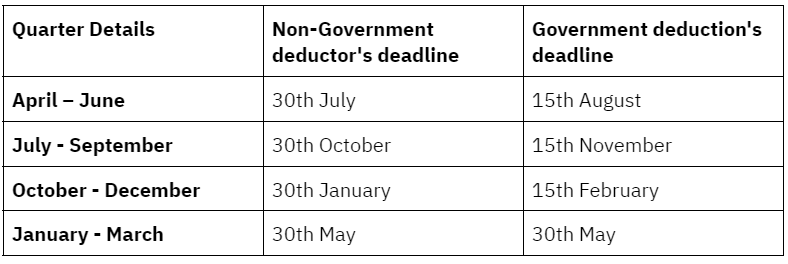

Return filing requirements u/s 194C

Every Deductor required to deduct TDS under Section 194C is required to submit a quarterly return in Form 26Q by the deadlines listed below:

Points to remember:

- Under section 194C, FD Commission and brokerage are not covered.

- Section 194C covers payments made to an electrician or contractor for rendering electrical services.

- The rules do not apply to travel agencies or airline payments to purchase a ticket. TDS must be deducted by section 194C, though, if the bus, aeroplane, or other mode is chartered.

- Section 194C applies to payments made to couriers.

- According to section 194C, payments made to clearing and forwarding agents for the transportation of goods are subject to TDS.

FAQs on Section 194C TDS

How does Section 194C work?

Any person paying a resident contractor for services provided between a resident contractor and a "specified person" is subject to the TDS provision governed by Section 194C. ( Specified person- central or state government, local authority, company, etc.)

What is the 194C threshold maximum limit?

TDS won't be deducted if a credit or payment made to a contractor under TDS Section 194C is less than the threshold limits for the section, which are INR 30,000 for a single transaction and INR 1,00,000 overall in a fiscal year.

What does TDS mean under section 194C?

TDS is deducted at the time of payment in cash, by the issuance of a check, a demand draft, or by any other mode at 1% of the gross amount of receipt.