Accounting, bookkeeping and maintaining a track record of all your transactions can be very cumbersome processes. Not to mention the process of getting your books audited by a firm and ensuring all the forms are in place. This can be a very tedious process for small, micro and medium enterprises. To ease the way of conducting business and ensuring a safe record of bookkeeping, the government has given some levies to small-time businesses. This comes under section 44ad of the Income Tax Act. In case a business has a turnover lower than a threshold, they can come under the presumptive income tax act, section 44AD of the Income Tax Act.

The presumptive tax act, Section 44AD, gives relief to small taxpayers and businesses who have a turnover of less than INR 2 crore in a particular financial year. Along with that, the other criteria necessary for individuals and firms to opt for the presumptive tax scheme is that the net income should be 8% of the total turnover and 6% of the total turnover in the case of digital receipts. If an individual or business falls under this category they can opt for the Section 44AD, presumptive tax scheme of the Indian Tax Act.

What is the Presumptive Tax Act, Section 44AD?

To reduce the paperwork and workload of small business owners and individuals, the government has introduced a tax scheme that does not require them to maintain regular books of account, getting the accounts audited from a third party or increase the formalities for filing their taxes. This is known as the presumptive tax act, Section 44AD of the income tax act.

Indian residents, Hindu United Family and small-time business owners are eligible to apply for their taxes under Section 44AD of the Income Tax Act. Section 44AD is a presumptive tax act that needs to be continued for a period of 5 years. Any change in the period of 5 years will make barre you opting for Section 44AD for 5 years. To be eligible for the presumptive scheme of section 44AD, Income Tax Act you need to fulfil the following criteria:

- The turnover of the business should be less than INR 2 crore.

- The Net Income or profit so to say should be at least 8% of the total turnover of the business. In the case of digital receipts, the net income should be 6%.

- In case the taxpayer wants to adopt the presumptive tax scheme of section 44AD of the Income Tax Act, they need to pay advance tax.

- The presumptive tax scheme needs to be consistent for 5 years. If there is a break in making the payment or the taxpayer isn’t eligible for the tax scheme anymore, they cannot opt for the presumptive tax for another 5 years.

If a taxpayer, business or individual fulfils all the eligibility criteria for the presumptive tax scheme, they are rewarded with a few benefits that reduce their paperwork and burden on their accounting.

What are the Benefits of the Section 44AD, Presumptive Tax of the Income Tax Act?

The reason behind introducing the presumptive tax scheme, Section 44AD, was to reduce the paperwork and stress put on small businesses and individual residents. Since filing for taxes can be cumbersome and expensive, they wanted to keep the process simple for small-time business employees. Due to this, anyone who qualifies to be able to file their taxes under Section 44AD is rewarded with a few benefits that make their tax filing process easier. Some of the benefits under the presumptive tax, Section 44AD of the Income Tax Act are:

- The taxpayer does not have to maintain an accounting record that is full proof or completely accurate

- The taxpayer does not have to get their accounting records audited from a third party firm

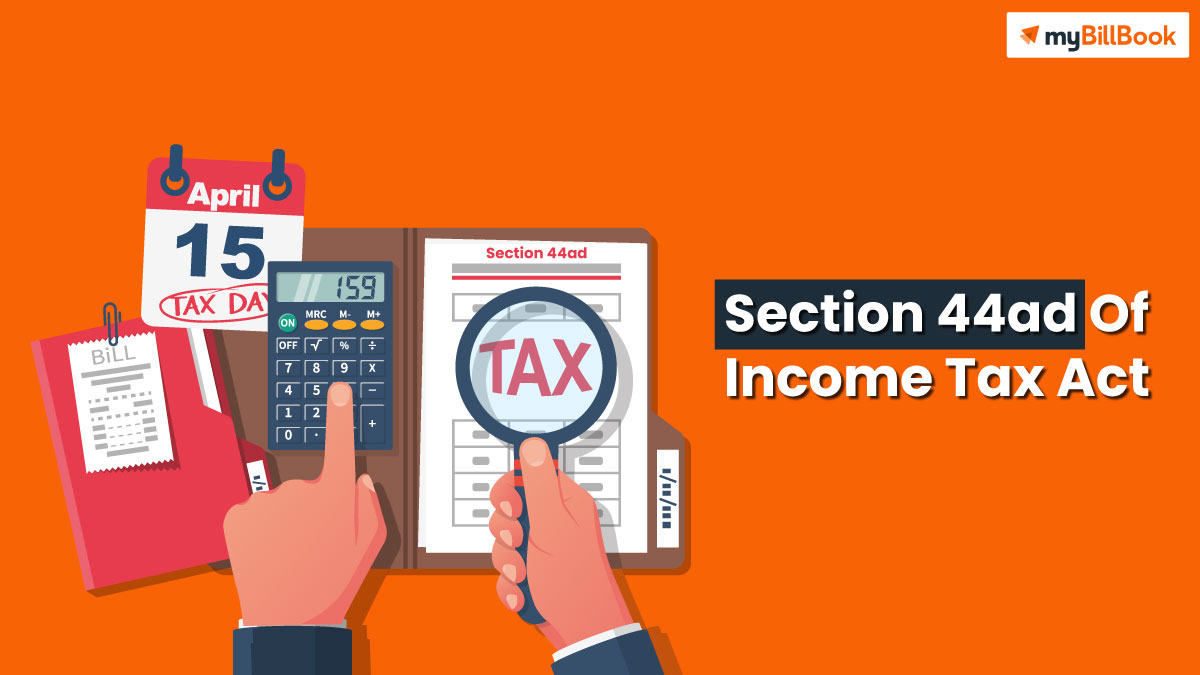

- The tax filing process is far easier compared to the general annual return process and the taxpayer needs to file for taxes under form ITR 4 as against the usual long route of filing the taxes under ITR 3

These are just a few of the benefits that a taxpayer gets for filing their taxes under Section 44AD of the Income Tax Act.

What are the conditions that need to be met to ensure one can file for taxes under Section 44AD of the Income Tax Act?

Since Section 44AD of the Income Tax Act provide benefits to taxpayers and ease the process of filing for returns and taxes there are some strict conditions that need to be met for one to file their returns under Section 44AD. If there is any break in the conditions being met or if one of the conditions is not met, then the taxpayer cannot file for their returns under section 44AD. The process of filing returns under the presumptive tax act is also for a period of 5 years and if there is some inconsistency in regards to that, then the taxpayer cannot file for returns under Section 44AD for a period of another 5 years. These points need to be kept in mind if you’re considering filing for returns under Section 44AD of the Income Tax Act.

Some of the other conditions that need to be met while filing for returns under Section 44AD are:

- The turnover of the business, individual or taxpayer should be less than INR 2 crore.

- The net income of the business should be 8% of the total turnover and 6% of the total turnover in the case of digital receipts. If the net income is higher than 8% then the taxpayer cannot file for taxes under section 44AD.

- The taxpayer is liable to pay the whole amount of advanced tax on or before 15th March of the previous financial year.

- The taxpayer is required to follow the presumptive tax scheme for 5 years and if the taxpayer opts out of the scheme then the taxpayer cannot choose the scheme again for another 5 years.

Example of Section 44AD of the Income Tax Act

Motilal and Co. have been generating a revenue of INR 1.5 crore consistently for a period of 3 years. Their net income on the turnover is around 5% and hence they chose to adopt the presumptive tax scheme of Section 44AD of the Income Tax Act. They fulfil all the criteria required for the tax scheme and hence are eligible to not get their accounts audited and can file their taxes under ITR – 4. However, in the 5th year, their net income rose to INR 2.3 crore. Due to this, they cannot file for their taxes under the presumptive tax scheme anymore as their turnover has exceeded the threshold level of INR 2 crore. Another condition is that since in the last year they did not meet the condition of the presumptive tax scheme, they cannot file for their taxes under section 44AD for another 5 years.

FAQs about Section 44AD of the Income Tax Act

1.What is section 44AD of the Income Tax Act?

Ans: The presumptive tax scheme of Section 44AD of the Income Tax Act is a way of filing for taxes for small-time businesses and firms. Section 44AD does not require heavy accounting or getting accounts audited from a third party. Due to this, it is a relief for small-time businesses to file for their taxes easily and seamlessly.

2.Who all are eligible for filing for their taxes under Section 44AD?

Ans: The presumptive tax scheme is open to

- Residents of Indian origin

- Hindu United Families

- Businesses and small micro and medium enterprises

3.For how long can one file for their taxes under section 44AD?

Ans: A taxpayer needs to file for their taxes under section 44AD of the Income Tax Act for a period of 5 consistent years.

4.What is the turnover and net income requirement to be qualified for Section 44AD?

Ans: The threshold limit for a turnover of the taxpayer should not exceed INR 2 crore and the net income should be 8% of the turnover and 6% in case of digital receipts.

Vat Value Added Tax

Section 80TTA Of Income Tax Act

Section 194A Of Income Tax Act

New Income Tax Portal

Income Tax

Corporate Tax

New Income Tax Rules Effective from 1st April 2022

Things Businesses Need to do Before the Financial Year End 2021-22

Last Dates/ Due Dates For GST and Income Tax Returns – March 2022

e-Invoicing Mandatory for Businesses with Turnover Above INR 20 Crore