Billing & Invoicing Software for Service Providers & Professionals

Trusted by thousands of CAs, Consultants, Freelancers, and Professionals across India.

A Tailored Billing Solution for Your Profession

From independent consultants to growing agencies, myBillBook is built to handle the unique billing challenges of your service business.

Find your solution below.

Hear From Professionals Like You

“myBillBook has been a game-changer for my consulting practice. Tracking billable hours and sending retainer invoices is now a breeze.”

Consultant, Delhi

As a graphic designer, the professional invoice templates and payment reminders have saved me countless hours of valuable administrative work.

Freelancer, Mumbai

“Managing multiple event vendor and client payments used to be a nightmare. myBillBook streamlines estimates and quick payment links effortlessly.”

Event Manager, Bengaluru

One Billing Software With All the Tools Your Service Business Needs

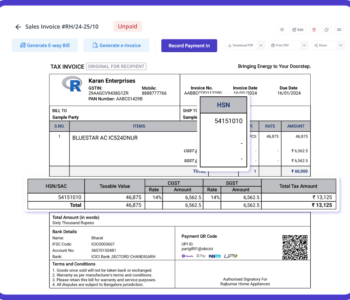

Professional GST Invoicing

- – Create GST-compliant invoices in seconds with automated tax.

- – Personalize invoices with your business logo, address..

- – Add custom fields like transport details, due dates.

- – Download, print, or share invoices instantly via WhatsApp, email.

Automated Payment Reminders

- – Set automatic payment reminders.

- – Customize frequency and tone.

- – Track sent, seen, and responded reminders.

- – Reduce manual follow-ups and stress.

Expense Management

- – Log all expenses in one place.

- – Categorize expenses for better tracking.

- – Upload receipts for future reference.

- – View monthly vs yearly expenses easily.

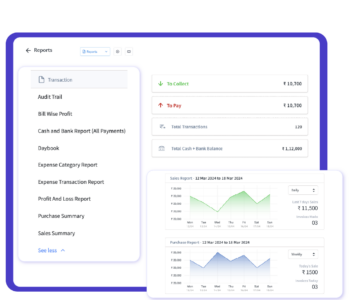

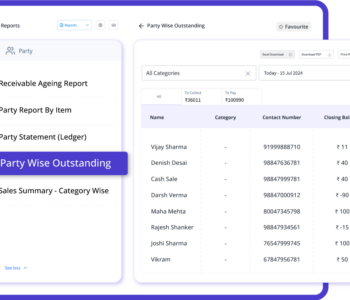

Insightful Business Reports

- – Access 25+ business reports.

- – View insights on sales and expenses.

- – Filter by customer, date, or location.

- – Export reports in PDF or Excel.

Client Management

- – Maintain a complete client database.

- – Track outstanding balances and payments.

- – Update ledgers with each transaction.

- – Send reminders via WhatsApp.

Product Demo of myBillBook

Affordable Pricing Plans for Every Business

Diamond Plan

₹217

Per month. Billed annually. Excl. GST @18%

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

Platinum Plan

₹250

Per month. Billed annually. Excl. GST @18%

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

Enterprise Plan

₹417

Per month. Billed annually. Excl. GST @18%

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills

Frequently Asked Questions

What should be included in an invoice for services in India?

An invoice for services in India must include your business name and GSTIN, the client's name and GSTIN, a unique invoice number, date, a detailed description of services with their SAC codes, the taxable value, GST rate and amount (CGST, SGST, IGST), and total invoice value.

How do I calculate GST for my services?

First, identify the correct SAC (Services Accounting Code) for your service, which determines the GST rate (commonly 5%, 12%, or 18%). Calculate the GST on the taxable value of your service. For example, if your service costs ₹10,000 and the GST rate is 18%, the GST amount is ₹1,800.

Is billing software necessary for a small service business or freelancer?

While not legally mandatory, it is highly recommended. Billing software automates repetitive tasks, ensures GST compliance, prevents manual errors, provides professional templates, and helps you get paid faster with features like payment reminders. It saves significant time compared to using Word or Excel.

How do you politely ask a client for payment on a late invoice?

The best way is to automate it. Use a billing software to send automated, polite reminders via WhatsApp or email. A typical sequence is a reminder a few days before the due date, on the due date, and then periodically after it becomes overdue.

What is the difference between a quote and an invoice?

A quote (or estimate) is a document sent before work begins, outlining the proposed services and their estimated cost. An invoice is a bill sent after the work is completed, requesting payment for the services rendered.

How do I manage billing for hourly work versus fixed-price projects?

For hourly work, use a tool to track time accurately against the project and bill based on the hours logged. For fixed-price projects, you can set up milestone-based billing (e.g., 50% upfront, 50% on completion) or bill the full amount upon completion using a clear, itemized invoice.

Can I create a GST-compliant invoice for free?

Yes, many platforms, including myBillBook, offer a free invoice generator. However, for a complete workflow including payment tracking, reminders, and business reports, a comprehensive billing software plan is more efficient.

What is an SAC code and why is it important?

SAC stands for Services Accounting Code. It's a system used in India under the GST regime to classify services for taxation purposes. Using the correct SAC code on your invoice is mandatory for GST compliance.

How can I make it easier for my clients to pay me?

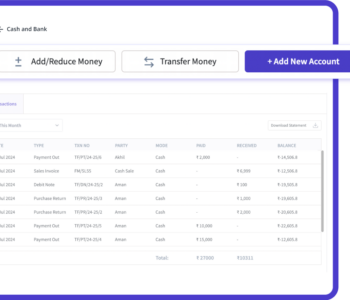

Offer multiple payment options. Your invoice should include your bank details (NEFT/IMPS) and a UPI QR code. Using a billing software with an integrated payment gateway allows clients to pay directly from the invoice link with a credit card, debit card, or UPI.

What's the best way to track the profitability of my projects?

Use an accounting or billing software that allows you to log both income (from invoices) and expenses (such as software costs, travel, etc.) associated with each project. This will allow you to run reports and see a clear profit and loss statement for each client or project.

A Guide to Streamlining Your Service Business Operations

For professionals in India – be it a consultant in Bengaluru, a graphic designer in Mumbai, or a CA firm in Delhi, your expertise is your greatest asset. You excel at serving your clients. But what about serving your business? Many skilled professionals often struggle with a simple task: getting paid. The administrative whirlpool of creating invoices, tracking payments, and managing compliance can consume your most valuable resource: time.

This guide explores how to move beyond the billable hour and build a streamlined, professional, and profitable operational workflow for your service-based business.

The Main Challenge: Managing Expertise and Administration

The reality for most service businesses is that you wear two hats: the expert and the administrator. While client work is fulfilling and profitable, administrative tasks are a task. Chasing late payments, correcting invoice errors, and tracking expenses are non-billable activities that directly impact your bottom line. The key to growth is minimizing these tasks through smart processes and powerful tools, allowing you to focus on what truly matters – your clients.

A Professional Invoice is Your Brand Ambassador

An invoice is more than just a payment request; it’s a reflection of your brand’s professionalism. A clear, accurate, and professional invoice builds client trust and, more importantly, gets paid faster.

What makes an invoice professional?

- Your Branding: Always includes your logo and contact information.

- Clear Client Details: The correct name, address, and GSTIN of your client.

- Unique Invoice Number & Date: Essential for tracking and accounting.

- Detailed Service Breakdown: Instead of a single line item, break down your services. For example, “Brand Consulting – 20 hours @ ₹2000/hr” and “Market Research Report – 1 Lump Sum” are clearer than “Consulting Services.”

- Correct HSN/SAC Codes & GST: Applying the correct SAC (Services Accounting Code) and calculating GST accurately is non-negotiable for compliance in India.

- Clear Payment Terms: Explicitly state the due date (e.g., “Due in 15 days”), accepted payment methods (UPI, Bank Transfer), and any late payment policies.

An incomplete invoice invites questions and delays. A professional one, generated consistently every time, streamlines the payment process from the very beginning.

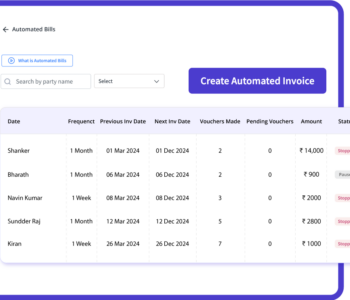

Beyond Invoicing: Automating the Financial Workflow

True efficiency isn’t just about creating a pretty invoice. It’s about automating the entire workflow that surrounds it.

1.From Hours to Invoices: Tracking Billable Time & Project Profitability

For consultants, lawyers, and freelancers who bill by the hour, accurate time tracking is the foundation of your revenue. Relying on messy spreadsheets leads to under-billing and lost income. Modern billing software allows you to track billable hours against specific projects and clients. When it’s time to bill, you can convert these tracked hours into an itemized invoice with a single click, ensuring you capture every rupee you’ve earned. This also provides critical data on which projects are truly the most profitable.

2.The Follow-Up Struggle: Automating Payment Reminders

One of the most uncomfortable tasks for any professional is chasing a client for payment. It’s awkward and time-consuming. This is where automation is a game-changer. Imagine a system that automatically sends a polite reminder via WhatsApp or SMS a few days before the due date, on the due date, and a few days after if the payment is late. This systematic approach drastically reduces late payments and improves your cash flow, all without you having to make a single phone call.

3.Staying Compliant: Simplified GST Compliance

GST compliance for services can be complex. You need to know the correct SAC code, apply the right GST rate (5%, 12%, 18%), and file your returns accurately. Using a dedicated GST billing software removes the guesswork. It helps you generate fully compliant invoices, provides a clear summary of your GST liabilities (GSTR-1), and makes the entire tax filing process smoother, saving you invaluable time and helping you avoid penalties.

The Power of Data: Making Informed Business Decisions

Are you profitable? What was your cash flow last quarter? Which client is your most valuable? A successful business runs on data, not guesswork. While individual invoices tell you about a single transaction, your billing system as a whole holds the key to your business’s financial health.

Modern billing software provides over 25 types of business reports at your fingertips. You can instantly generate a Profit & Loss statement, track your expenses versus your income, and see which services are most in-demand. This data empowers you to make smarter decisions—from adjusting your pricing to focusing on high-value clients—and strategically grow your business.

Build a Business That Serves You

Your skill as a professional deserves a business operation that supports, not hinders, it. By bringing professionalism in your invoicing, automating your financial workflows, ensuring compliance, and leveraging your own data, you can build a more resilient, profitable, and scalable service business. The right tools can transform your administrative tasks from a daily burden into a streamlined, automated engine for growth.